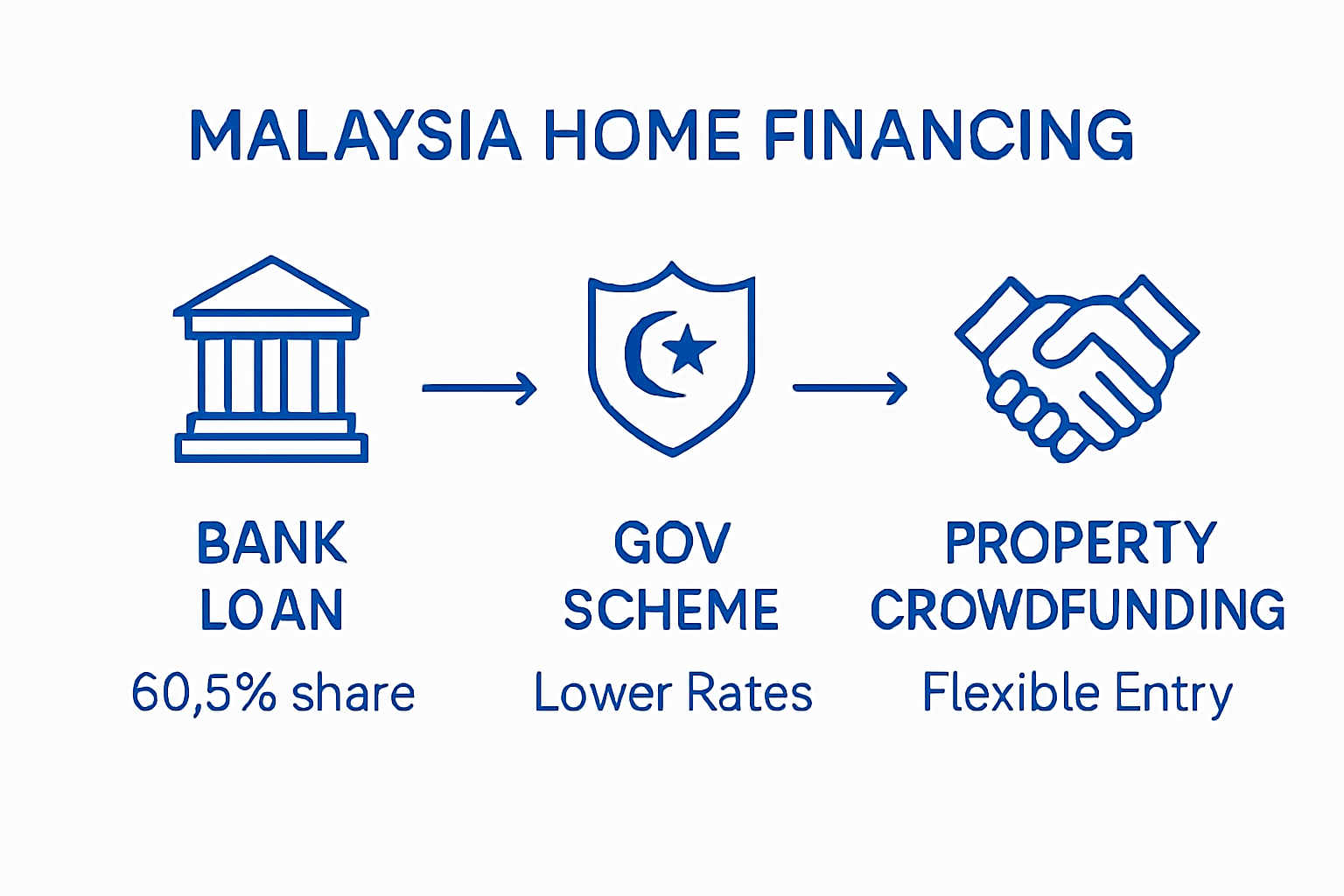

Owning a home in Malaysia is often seen as the cornerstone of personal success and financial security. Yet the process is anything but simple and involves an array of legal paperwork and financial hurdles at every step. Surprisingly, housing loans now make up a staggering 60.5 percent of household debt in Malaysia, showing just how financially intense the journey has become for millions. There is more to the home ownership story than ticking boxes and signing forms—and understanding the hidden realities could change how you approach your own property dreams.

Table of Contents

- What Is The Home Ownership Workflow In Malaysia?

- Why Home Ownership Matters In The Malaysian Context

- Key Steps And Concepts In The Home Ownership Process

- Understanding Financial Considerations For Home Buyers

- Exploring Government Initiatives And Housing Schemes

Quick Summary

| Takeaway | Explanation |

|---|---|

| Understand the home ownership workflow | Familiarise yourself with the key stages in Malaysia’s property acquisition process to ensure a successful transaction. |

| Prepare financial documents and assessments | Ensure all necessary financial documents, including proof of income and credit evaluations, are ready before starting the home purchase process. |

| Utilise government housing schemes | Explore various government initiatives aimed at facilitating homeownership for different income groups, offering support and financial incentives. |

| Focus on legal documentation | Ensure you have essential legal papers, such as property titles and sales agreements, to streamline the ownership transfer process. |

| Consider alternative financing options | Investigate innovative financing methods available in Malaysia, such as crowdfunding or joint ownership, to overcome traditional barriers. |

What is the Home Ownership Workflow in Malaysia?

The home ownership workflow in Malaysia represents a comprehensive process that guides individuals through acquiring residential property, involving multiple legal, financial, and administrative steps. Understanding this workflow is crucial for potential homeowners navigating the complex Malaysian property landscape.

Fundamental Components of Home Ownership

The Malaysian home ownership workflow encompasses several interconnected stages that transform property acquisition from a conceptual aspiration to a tangible reality. These components are designed to protect both buyers and sellers while ensuring transparent, legally compliant property transactions.

Key foundational elements include:

- Legal verification of property ownership

- Financial assessment and loan approval

- Property title transfer procedures

- Comprehensive documentation requirements

Navigating Procedural Complexities

Malaysia’s home ownership process is uniquely structured, reflecting the nation’s intricate regulatory environment. According to research published in Planning Malaysia, the workflow integrates government policies, financial institutional guidelines, and legal frameworks to streamline property acquisition.

The process demands meticulous attention to detail, with potential homeowners required to demonstrate financial stability, understand regulatory requirements, and complete numerous administrative procedures. Learn more about streamlining your homeownership journey through comprehensive guidance and expert support.

Critical documentation typically includes:

- Proof of income

- National identification documents

- Property valuation reports

- Comprehensive loan application materials

Understanding the home ownership workflow is not merely about following prescribed steps but comprehending the intricate interactions between legal, financial, and administrative systems that govern property transactions in Malaysia. Each stage represents a critical checkpoint designed to protect buyers, ensure transparency, and maintain the integrity of property ownership transfers.

Why Home Ownership Matters in the Malaysian Context

Home ownership in Malaysia transcends mere property acquisition, representing a profound socioeconomic milestone that intertwines personal aspirations with national development strategies. It serves as a critical mechanism for wealth generation, financial security, and social stability within the Malaysian economic landscape.

Economic Empowerment and Personal Wealth

For Malaysian families, property ownership represents more than a residential investment. According to research from the University of Malaya, home ownership acts as a fundamental pathway to intergenerational wealth accumulation and financial resilience.

Key economic advantages include:

- Building long-term personal equity

- Creating a stable financial asset

- Generating potential rental income

- Establishing a foundation for future investment opportunities

Social and Cultural Significance

Home ownership carries deep cultural significance in Malaysian society, symbolising personal achievement and family stability. Understand the challenges facing first-time homeowners and the broader socioeconomic context that shapes property acquisition.

The cultural dimensions of home ownership encompass:

- Demonstrating social mobility

- Providing family security

- Establishing community roots

- Reflecting personal and professional success

Beyond individual benefits, home ownership plays a strategic role in Malaysia’s national development agenda. The government recognises property ownership as a mechanism for economic empowerment, particularly for middle-income and emerging professional communities. By facilitating accessible property markets and supportive financing mechanisms, Malaysia aims to create sustainable pathways for citizens to achieve residential security and build long-term financial portfolios.

Key Steps and Concepts in the Home Ownership Process

The home ownership process in Malaysia involves a sophisticated sequence of legal, financial, and administrative procedures that demand strategic planning and comprehensive understanding. Navigating these steps requires careful preparation, meticulous documentation, and a clear comprehension of regulatory frameworks.

Financial Preparation and Assessment

Financial readiness forms the foundational cornerstone of successful home ownership. According to the Department of Director General of Lands and Mines, potential homeowners must demonstrate robust financial stability before initiating property acquisition.

Key financial considerations include:

- Comprehensive credit score evaluation

- Mortgage affordability assessment

- Proof of consistent income streams

- Sufficient down payment resources

Legal Documentation and Property Verification

Legal documentation represents a critical phase in the Malaysian home ownership workflow. Learn more about navigating complex property requirements to ensure a smooth acquisition process.

Critical legal documentation typically encompasses:

This table outlines the core legal documents required for property purchases in Malaysia, briefly explaining the role of each document in the home ownership process.

| Document Type | Role in Home Ownership Process |

|---|---|

| Original property title | Verifies legal ownership and details of the property |

| Comprehensive sales agreement | Defines terms and conditions of the sale |

| Ownership transfer consent form | Obtains permission for official transfer of ownership |

| Government-issued identification document | Confirms the identity of buyer and seller |

- Original property titles

- Comprehensive sales agreements

- Ownership transfer consent forms

- Government-issued identification documents

The home ownership process demands a holistic approach that integrates financial planning, legal compliance, and strategic decision-making. Potential homeowners must view this journey as a comprehensive investment in their future, requiring patience, thorough research, and professional guidance to successfully navigate Malaysia’s intricate property landscape.

Understanding Financial Considerations for Home Buyers

Financial considerations form the bedrock of successful home ownership in Malaysia, representing a complex interplay of personal economic capacity, market dynamics, and strategic planning. Potential homebuyers must navigate a nuanced landscape that demands sophisticated financial comprehension and forward-thinking approaches.

Debt and Income Dynamics

The Malaysian housing market presents unique financial challenges for prospective homeowners. According to research highlighting household debt trends, housing loans constitute a substantial 60.5% of household debt, underscoring the critical importance of strategic financial planning.

Key financial considerations include:

- Maintaining a healthy debt-to-income ratio

- Understanding long-term financial commitments

- Evaluating sustainable mortgage options

- Building robust emergency financial reserves

Alternative Financing Strategies

Traditional financing models are evolving, offering Malaysian homebuyers innovative approaches to property acquisition. Explore emerging home financing opportunities that can help overcome traditional financial barriers.

Emergent financing strategies encompass:

- Property crowdfunding platforms

- Government-supported first-time buyer schemes

- Flexible mortgage instruments

- Joint ownership and collaborative purchasing models

Successful home ownership demands more than simply securing a property. It requires a holistic financial strategy that balances immediate affordability with long-term economic sustainability, recognising that each financial decision reverberates through an individual’s broader economic trajectory.

Exploring Government Initiatives and Housing Schemes

Government initiatives in Malaysia represent strategic interventions designed to democratise home ownership, addressing complex socioeconomic challenges by creating accessible pathways for diverse income groups. These comprehensive schemes aim to bridge the gap between housing market dynamics and citizens’ economic capabilities.

The table below summarises different government housing support programmes in Malaysia, detailing their main purpose and the target group they serve.

| Programme Name | Main Purpose | Target Group |

|---|---|---|

| My First Home Scheme (Skim Rumah Pertamaku) | Facilitate home ownership by easing loan requirements | First-time homebuyers |

| Affordable Housing Programme | Provide affordable housing options | Low- to middle-income groups |

| Youth Housing Ownership Programme | Increase accessibility for young adults | Malaysian youth |

| Special Bumiputera allocation schemes | Support property ownership among Bumiputera communities | Bumiputera citizens |

Targeted Housing Support Programmes

The Malaysian government has developed nuanced housing support mechanisms to address specific demographic needs. According to research from the Ministry of Economy, these initiatives focus on creating sustainable pathways to property ownership for different societal segments.

Key government housing support programmes include:

- My First Home Scheme (Skim Rumah Pertamaku)

- Affordable Housing Programme (Program Perumahan Rakyat)

- Youth Housing Ownership Programme

- Special Bumiputera housing allocation schemes

Innovative Financing and Accessibility Strategies

Financial innovation plays a crucial role in expanding home ownership opportunities. Understand the challenges facing potential homeowners and explore the government’s strategic responses.

Innovative financing approaches encompass:

- Housing Credit Guarantee Scheme

- Flexible loan mechanisms for B40 and M40 income groups

- Reduced down payment requirements

- Preferential interest rates for first-time buyers

These government initiatives represent more than mere financial support. They embody a comprehensive national strategy to enhance social mobility, economic stability, and community development by making home ownership a tangible reality for a broader spectrum of Malaysian citizens.

Take Control of Your Journey to Home Ownership with RumahHQ

Are you overwhelmed by the complex home ownership workflow in Malaysia? Struggling with documentation, financial planning or unclear processes for building your dream home? The journey outlined in the article highlights how legal, financial and administrative barriers can drain your confidence and slow you down. At RumahHQ, we understand these pain points and help you bridge the gap between owning property and turning it into a sanctuary. We deliver end-to-end construction solutions, legal approvals and tailored financing through platforms such as LPPSA or KWSP, giving you peace of mind from initial planning to project handover.

Ready to experience a truly transparent, simplified way to build your home in Selangor or Kuala Lumpur? Explore our free design consultations and discover how our fixed-price packages and structure warranties offer certainty where others leave questions. Take your next step now with RumahHQ and learn how you can transform today’s challenges into tomorrow’s comforts. If you want genuine support and step-by-step guidance through your unique home ownership workflow, find out more here.

Frequently Asked Questions

What are the main steps in the home ownership workflow in Malaysia?

The main steps include legal verification of property ownership, financial assessment and loan approval, property title transfer procedures, and comprehensive documentation requirements.

How important is financial readiness for home ownership in Malaysia?

Financial readiness is crucial as it involves demonstrating financial stability, evaluating credit scores, assessing affordability, and preparing sufficient down payment resources before initiating the property acquisition process.

What legal documents are required for purchasing a property in Malaysia?

Key legal documents typically include original property titles, comprehensive sales agreements, ownership transfer consent forms, and government-issued identification documents.

What government initiatives support home ownership in Malaysia?

The government has established various housing support programmes, such as the My First Home Scheme, Affordable Housing Programme, and Youth Housing Ownership Programme, aimed at facilitating access to home ownership for diverse income groups.

Recommended

- Why Malaysian Millennials are Struggling to Own Homes: The Harsh Truth | RumahHQ – Kontraktor Bina & Renovate Rumah

- Why Residential Construction in Malaysia is More Affordable Than You Think | RumahHQ – Kontraktor Bina & Renovate Rumah

- How RumahHQ is Making Homeownership Dreams Come True for Malaysians | RumahHQ – Kontraktor Bina & Renovate Rumah

- How to Snag Your Dream Home in Malaysia: 10 Insider Secrets | RumahHQ – Kontraktor Bina & Renovate Rumah